This will assist you in identifying the amount you will have to obtain through alternative ways of financing. The following are a few of the best financing options for house additions when you do not have the needed amount of cash on hand: House Equity loans are a bit like a second mortgage on your house, where you keep the home's equity as the loan collateral. Though home equity loans traditionally have a greater rate of interest, such loans are easy to protect because a lot of lending institutions consider it a safe financial investment. Typically, a loan provider can provide you a loan against your house equity for as much as 80% to 90% of the worth of your home.

However, the drawback is that there are a lot of extra costs included, such as maintenance costs and closing costs. Furthermore, if you fail to pay on your loan, you will be at threat of losing your house. This technique of financing is fantastic for property owners who need a substantial financial investment for their house addition. For instance, if you are preparing to add another story to your house, you can probably think about cash-out equity refinancing. Under this option, you basically get a big home loan that allows you to totally settle the earlier mortgage and leaves you with adequate cash to finance the home addition.

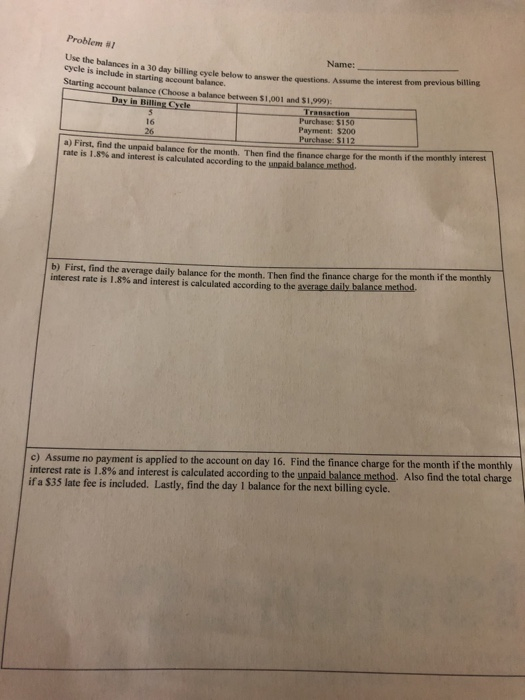

Nevertheless, it typically features a quite substantial processing fee. What can be an easier technique of funding any purchase wholepoint systems, llc than simply turning over your charge card? Credit cards can be an exceptional financing alternative but only when the quantity needed is substantially low. Also, with this technique, you will get the charge card bill as you frequently do. So, you will have to guarantee you have adequate liquidity to settle the charge card expense on time. You can also take out an individual loan to pay the credit card expense. If you do not wish to put your home equity on the line, the next best way to fund your house addition is through an individual loan.

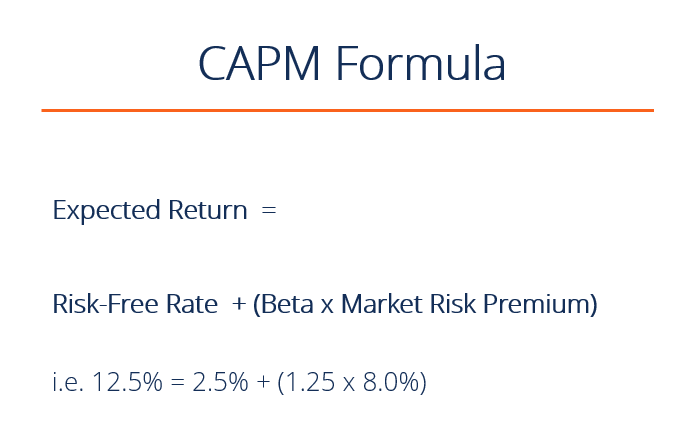

Nevertheless, before approving a personal loan, the majority of loan providers will typically ensure you have a great credit score. They will likewise have a look at your credit history, your current payment capability, and your debt-to-equity ratio. For that reason, you will need to guarantee all of these elements are in good standing prior to looking for a personal loan. Getting a personal loan from Stilt is an extremely simple, three-step process: You can complete an online application. Since a Stilt loan is intended to offer financing alternatives to those who are non-US residents, you do not necessarily need a Social Security Number to get the loan. Lower your regular monthly home mortgage payment and utilize the additional money each month to pay expenses. Use your house equity to take cash out and use the squander to remodel your house and potentially increase its worth or pay expenses. Re-financing your home loan usually suggests that you begin over from year one of a new 30-year home mortgage. This suggests that it will take you many years to settle the financial obligation from your home addition. For instance, with common home loan terms, you may wind up paying back the expense of the house addition over 30 years. (Unless you established your re-financed mortgage to have a much shorter repayment duration, such as 25 years or 15 years, or established accelerated mortgage payments.) Rather of re-financing your home loan, this alternative lets you borrow versus the worth of your built-up house equity.

Instead of settling your home remodelling debt over 30 years, a house equity loan or credit line offers you an additional bill to pay every month different from your current mortgage payment. A house equity loan has a set quantity and a fixed payment term such as 10, 20 or even 30 years. A home equity line of credit (or HELOC) works more like a charge card normally with a ten years draw period followed by a 20 year re-payment duration. With HELOCs, debtors are frequently needed to make interest and principal payments throughout the re-payment duration and there is frequently a variable rates of interest.

This can be accomplished by taking a loan higher than your very first mortgage balance, paying off your very first mortgage, and taking the difference in cash for your house improvement requirements. No need to renovate your home mortgage payment schedule as you would with a refinance. Also, house equity loan/line of credit financial obligation is normally low interest debt since it is secured by your home. House equity loans may include low or no costs. For instance, Discover Home Loans charge $0 applications costs, $0 origination fees, $0 appraisal costs, and $0 money at closing. The house equity line of credit is a particularly versatile choice because you can borrow as much or as low as you need (within an approved credit limitation) and then pay it back on your own schedule.

Beware not to obtain too much money from your house equity. Don't treat your house equity like a piggy bank and if you take out a HELOC, you may think about asking for a lower borrowing credit line than for which you qualify. Some house addition costs can be spent for with a credit card, much like any other household cost. If you require to purchase brand-new structure products or pay specialists for their work on your house, depending upon the amounts included, it might be easier to simply put those bills on your credit card and settle the financial obligation along with your normal monthly expenses.

Fascination About Why Are You Interested In Finance

If you only need a few thousand dollars for your home repair work or wesley dale smith remodelling, you might think about putting that cost on your credit card particularly if you can earn credit card rewards points. Home enhancement stores might use initial 0 percent APRs if you apply for a brand-new charge card through their store so if you need to make some significant purchases for a house addition, and you're doing most of the service through a significant merchant, check out your choices for a brand-new installment plan card - Which of these is the best description of personal finance. Depending upon the particular terms, and if you have a sufficient credit history, you might qualify to pay off the entire amount within 12 months and pay no interest.

Also, take care when registering for 0 percent interest uses if you do not pay off the total within the initial period, sometimes you can owe interest on the complete original balance on the card. Marketing 0 percent interest charge card can be a good deal but, to avoid interest and charges, you need to read the fine print thoroughly and make sure to pay off the full balance within the specified 0 percent time duration. Improving your home is an investment of time, money and energy (both physical and psychological) so make certain you feel comfy with whatever alternative you pursue to finance a house addition.

If you do not get approved for those options or do not want to go through the lengthy process of using for a refinance or house equity loan, think about paying for your house remodelling with a charge card particularly if you get rewards points or can get approved for an unique low-interest initial deal on a brand-new charge card. Published March 26, 2018. Updated October 27, 2020. This site is for instructional functions and is not a replacement for expert guidance. The product on this website is not meant to supply legal, investment, or financial advice and does not indicate the accessibility of any Discover services or product.

Property owners typically imagine a new cooking area, home addition or master bath remodel, however put it off due to the fact that they believe financing is beyond their reach. What they might not realize is there are a number of methods to fund a house renovation besides the conventional home equity loan. By selecting a budget friendly financing technique, property owners can enhance their home and the worth of their home for an affordable regular monthly expense. Before meeting with a loan provider, determine wfg financial the scope of the project and get an estimate on the cost then include 10 percent for cost overruns. If you are doing the work yourself, make a comprehensive list of all products and allow charges.

Remember to consider the schedule and approximated time of completion (How to finance a car from a private seller). If the task will take a couple of months to complete, that could influence your funding choices. A home equity home mortgage has actually long been a reliable means for house owners to fund large improvement tasks. By working with your bank or cooperative credit union, you can obtain cash against the balance of your house's equity, paying it off over 15 to thirty years sometimes. These loans are tax deductible and bring a fixed rates of interest, but that rate is usually greater than a conventional home mortgage. A house equity credit line is a flexible option for lengthy remodellings and DIY projects.